Investor Relations

Governance

Corporate Governance Practices

Corporate Governance Officer

1. Appointment and job scope of the corporate governance officer:

To ensure the sound operation of the Company’s corporate governance framework and to further enhance the effectiveness of the Board of Directors, the Company appointed a Corporate Governance Officer, with the approval of the Board of Directors, in May 2019.

The Corporate Governance Officer is responsible for corporate governance–related matters, including, in accordance with applicable laws and regulations, handling meeting-related affairs of the Board of Directors, the Audit Committee, the Compensation Committee, the Sustainable Development Committee, and shareholders’ meetings; assisting directors with their onboarding and continuing professional education; providing directors with information necessary for the performance of their duties; and assisting directors in complying with relevant laws and regulations.

The Corporate Governance Officer serves as the senior executive exclusively responsible for corporate governance matters and possesses more than three years of management experience in areas such as finance, shareholder services, and meeting administration.

2. Tasks completed by the corporate governance officer in 2025:

- (1)Provided directors with continuing education course information and reminded them to complete the courses and report the status of completion pursuant to the "Guidelines for the Implementation of Continuing Education for Directors and Supervisors of TWSE Listed and TPEx Listed Companies".

- (2)Assessed and purchased Directors and Officers Liability Insurance for board members and reported details of the policy to the board.

- (3)Organized meetings of CPAs, independent directors and officers of auditing, finance and accounting to communicate for internal audit and internal control purposes. Minutes of such meetings are available on the corporate website at https://www. cwei.com.tw.

- (4)Conducted board and committee meetings pursuant to relevant laws and regulations: notified all directors and members to attend the board and committee meetings seven days in advance and provided sufficient information to facilitate directors' understanding of agenda items; reminded directors before the meeting to recuse themselves from agenda items where they or the juridical persons they represented had personal interests; and distributed the meeting minutes to each director within 20 days after the meeting.

- (5)Released material information or announcements of important resolutions afterwards on the days of the board and shareholders' meetings and ensured the legal compliance and accuracy of the information to protect investors from information symmetry.

- (6)Conducted board performance assessments annually in accordance with CWE's "Self-Evaluation or Peer Evaluation of the Board of Directors".

- (7)Provided directors with regulatory updates related to business execution, corporate governance or operations.

- (8)Registered the date of shareholders’ meeting pursuant to applicable laws and regulations, prepared meeting notice, agenda and minutes within the prescribed deadline and registered changes to the Articles of Incorporation or the election of directors on a timely basis.

- (9)Promoted corporate governance matters. Reviewed item by item each year the achievement of the corporate governance assessment indicators, and proposed improvement plans and measures to address the indicators that did not score.

- (10)Provided operational information such as business or finance as required by the directors and maintained smooth communication between the directors and business executives.

- (11)In order to prevent insider trading, CWE reminded directors and insiders who had learned of the Company's financial reports or relevant information that they shall not trade the Company's shares in the open market during the 30-day period before the release of annual financial report and the 15-day period before the release of quarterly financial reports pursuant to Article 10 of the "Corporate Governance Best-Practice Principles for TWSE/TPEx Listed Companies".

3. Continuing education of corporate governance officer in 2025:

| Organizer | Course | Date | Duration | Total Hours |

|---|---|---|---|---|

| Securities and Futures Institute | Sustainable Disclosure Practice Training for Listed Companies | 2025/03/27 ~ 2025/03/28 |

9 | 12 |

| Securities and Futures Institute | 2025 Seminar on Legal Compliance for Insider Shareholding Transactions | 2025/08/15 | 3 |

Prevention of insider trading

1. In order to prevent insider trading, avoid improper disclosure of information and ensure the consistency and accuracy of information released to the public, CWE held the " Insider Trading Prevention Training" for directors and managers in December 2025. A total of 16 participants attended the 10-minute educational seminar, representing 100% of CWE's directors and managers.

2. The seminar focused on the definition of insider trading, associated criminal and civil liabilities and case studies to prevent violations of relevant laws, strengthen corporate governance and build a corporate culture which prevents insider trading.

3. The Company’s Board of Directors revised the Procedures for Handling Material Internal Information on December 20, 2022, and established the Management Procedures for the Prevention of Insider Trading on December 21, 2023. Beginning in 2024, the Company has provided quarterly reminders to directors that they are prohibited from trading the Company’s shares or other equity-type securities on the public market during the blackout periods, namely the 30 days prior to the announcement of the annual financial reports and the 15 days prior to the announcement of each quarterly financial report. In 2025, the Company notified directors and managers by email in February, April, July, and October of the blackout periods prior to the announcement of each quarterly financial report, in order to remind insiders to avoid inadvertent violations of the relevant regulations.

Executive Compensation Linked to ESG Performance

The Company’s executive compensation structure is linked to performance and is paid in accordance with the “Standards, Policies, and Structure for Executive Compensation,” subject to periodic review by the Remuneration Committee and approval by the Board of Directors. The compensation structure for executives consists of salary, allowances, bonuses, benefits, employee remuneration, and retirement or pension contributions. Salaries and allowances are determined based on education, experience, professional capabilities, and the position held, in accordance with the Company’s personnel management regulations. Bonuses are tied to performance evaluations and the Company’s operational results.

For senior executives (such as the General Manager and Deputy General Managers), performance assessment includes financial targets—such as pre-tax net profit, earnings per share, achievement of operating profit budgets, and industry comparisons—and non-financial targets, primarily based on corporate governance evaluations, which cover operational management capabilities, risk management abilities, and ESG performance indicators. Bonuses are calculated according to the assessment results to provide reasonable remuneration.

Benefit standards are established to balance employee needs with the Company’s talent retention policies. Relevant benefit measures are provided and are reviewed as necessary based on actual business conditions and applicable laws and regulations to ensure the compensation system remains appropriate.

| Assessment Criteria | General Manager | Vice President |

|---|---|---|

| Pre-Tax Net Profit | 20% | 20% |

| Earnings Per Share | 20% | 15% |

| Achievement of Operating Profit Budget | 30% | 35% |

| Operating Profit Margin Compared to Industry Peers | 15% | 15% |

| Debt Ratio Compared to Industry Peers | 15% | 15% |

| Corporate Governance Evaluation (including ESG indicators [Note]) |

10% | - |

Note: ESG indicators are based on relevant items covered in the corporate governance evaluation and serve as the core, including but not limited to: Board operation and decision-making quality, risk management and internal control systems, legal compliance and ethical business practices, and sustainability information disclosure and transparency.

In addition, to promote employee health, the Company has embraced the ESG spirit by encouraging employees to quit smoking. Quitting smoking improves the respiratory system, reduces the risk of disease, and lessens the environmental impact of tobacco, thereby contributing to both health and environmental sustainability. The Company incorporates this initiative into the non-financial performance assessment of senior executives, aligning with the SDGs goals of “Good Health and Well-Being” and “Climate Action.” The evaluation for this initiative accounts for at least 2%–3% of the total compensation for the General Manager and Vice Presidents.

Succession Planning for Board Members and Key Management

I. Succession Planning and Operations for Board Members

The Company’s board of directors is elected in accordance with the Articles of Incorporation through a candidate nomination system. The Corporate Governance Best Practice Principles and the Procedures for Board Member Election specify that the composition of the board should take diversity into consideration. In line with the Company’s operational needs, business model, and development requirements, a diversity policy has been established, covering but not limited to two main dimensions: fundamental qualifications and values, as well as professional knowledge and skills.

The structure of the board of directors is determined by considering the scale of the Company’s operations and development, the shareholding of major shareholders, and practical operational needs.

The ongoing board succession plan is supported by a candidate database developed according to the following criteria:

1. Integrity, reliability, professionalism, and innovation, aligned with the Company’s core values, and possessing professional knowledge and skills beneficial to corporate management.

2. Relevant industry experience related to the Company’s business operations.

3. The prospective member is expected to contribute to the formation of an effective, collaborative, diverse, and needs-aligned board of directors.

4. The collective expertise of the board should encompass corporate strategy and management, accounting and taxation, finance, and legal matters.

5. The process for selecting board candidates complies with qualification screening and relevant regulations, ensuring that when a board seat becomes vacant or an additional position is planned, suitable candidates can be effectively identified and selected.

The Company has also established the Board Performance Evaluation Guidelines. Through evaluation metrics—including the understanding and execution of company objectives and missions, role awareness, operational participation, internal relationship management and communication, professional competence and continuing education, internal controls, and the articulation of concrete opinions—these evaluations confirm the board’s operational effectiveness and assess individual directors’ performance, providing a reference for future director selection.

II. Succession Planning and Operations for Key Management

Employees at the Assistant Manager level and above are considered key management, responsible for relevant business management functions within the organization. Each management level has designated deputies for their roles. In addition to possessing necessary professional skills and experience, key management personnel are expected to share values and management philosophies consistent with the Company’s corporate culture, which is grounded in Gratitude, Responsibility, Cherishing, and Giving Back.

To develop key management personnel and their deputies, the Company provides practical training through professional skill development and corporate governance courses, alongside on-the-job training, including attending board meetings and participating in project-based task management.

Weekly senior management meetings are held to discuss operational targets, business strategies, risk management, market trends, and other topics. These meetings aim to cultivate innovation and decision-making skills in potential successors while leveraging the experience of top leaders to share organizational culture and practical management leadership.

The Company conducts annual employee performance evaluations. Through regular observation and performance assessments, areas for improvement, individual development needs, and the Company’s expectations are identified, and the results serve as a reference for future succession planning.

Risk Management and Implementation Report

Risk Management

To ensure proper guidance for the Company’s risk management operations and to effectively manage risks, the Risk Management Policy was established in 2023. The policy is reviewed periodically and submitted to the Board of Directors for approval prior to the annual group risk assessment, serving as the Company’s highest guiding principle. Each functional unit is responsible for identifying risks according to its professional duties and developing management strategies and response plans to mitigate, transfer, or avoid risks, thereby effectively reducing operational risk.

To ensure normal business operations and achieve sustainable corporate management, the Company actively and cost-effectively integrates and manages all potential risks that could affect operations and profitability, including strategic, operational, financial, and hazardous risks. Through regular group risk assessments, a risk matrix is used to evaluate the likelihood of risk events and the severity of their impact on the Company’s operations. This allows the Company to define risk priorities and levels and implement corresponding risk management strategies according to the assessed risk levels.

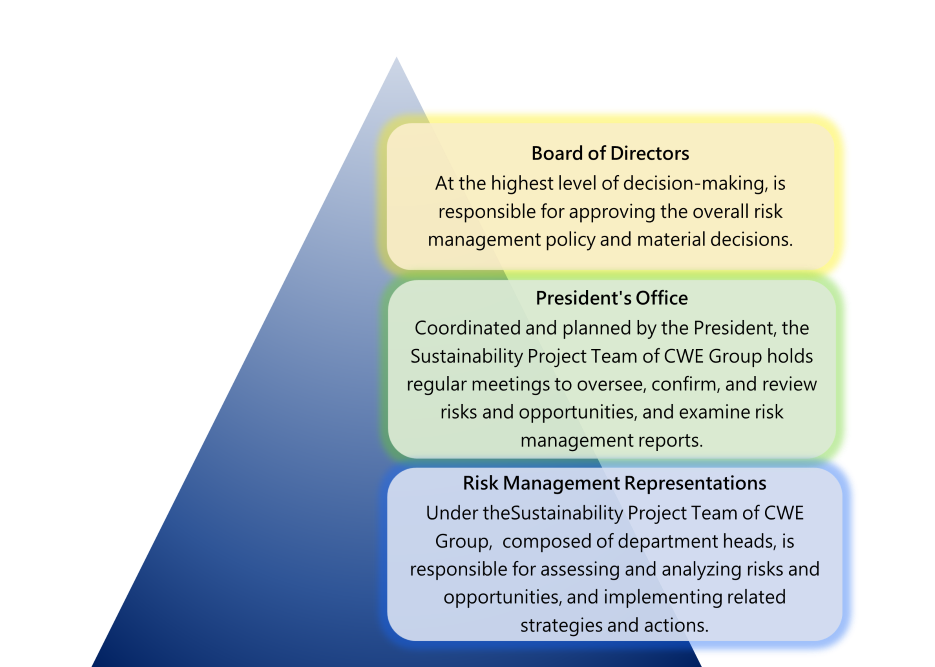

Risk Management Organizational Structure and Related Responsibilities

Risk Identification and Countermeasures

Our risk management process includes elements such as risk identification, risk assessment, risk response, risk monitoring, and risk management information communication and handling. In addition to assessing the overall impact of various risks on the Company through cross-departmental communication and data collection, the degree of each risk's impact is also linked to the Company's short, medium, and long-term operational goals to gauge its risk tolerance. To implement the risk management mechanism, a group risk assessment is conducted annually, and the results of the risk assessment are regularly reported every year to the Audit Committee (composed of three independent directors) and the Board of Directors. The report includes a summary of the various risks the Company faces during the year, risk response measures, and planned improvements, which are subsequently tracked annually. The Audit Office is notified of the tracking results, and it conducts risk management audits to ensure the effective operation and execution of the Company's risk management.

Implementation of Risk Management

On December 18, 2025, the Company submitted a Risk Management Implementation Report to the Board of Directors. The Company classifies risks by type, including operational, financial, environmental, social, and corporate governance risks. The major risks and corresponding mitigation measures are as follows:

| Material Issue | Risk Identification | Measures |

|---|---|---|

| Operations | Industry Competition: Industry competition is intensifying, and emerging competitors are capturing the lower-end market with lower prices. |

•

Expand regional presence and strengthen customer relationships in the Asia-Pacific market to enhance customer loyalty and trust.

•

Provide one-stop integrated total solutions for supply chain clients, creating added value to compete in the highly competitive industry.

|

| Profit Margin Compression: Revenue is concentrated in semiconductor and optoelectronic materials/equipment, and geopolitical and international situations bring uncertainty to the market. |

•

Broaden product applications and enhance product reliability to increase customer satisfaction.

•

Increase value-added services by elevating technical support levels and establishing close links with upstream and downstream partners in the supply chain. Continue efforts with the goal of "comprehensive solutions; creating a win-win with customers."

|

|

| High-End Product Entry Barriers |

•

Maintain close collaboration with customers, actively participate in and introduce corresponding high-end packaging materials to gain early market advantage.

•

Monitor developments in high-end products and technologies and introduce optimal materials to packaging plants as needed.

|

|

| Financial | Interest Rate Impact |

•

Regularly assess money market interest rates and financial information.

•

Choose the most favorable funding methods considering capital costs and potential return risks.

|

| Exchange Rate Impact |

•

Achieve natural hedging through transactional activities and adjust foreign currency assets and liabilities as appropriate.

•

Use professional financial information systems to monitor international exchange rate movements in real time and proactively respond to negative effects from currency fluctuations.

•

Regularly evaluate foreign currency net assets (liabilities) and conduct currency exchanges as needed to mitigate exchange rate risk.

|

|

| Inflation Impact |

•

Closely monitor upstream raw material price fluctuations.

•

Maintain good interactions with suppliers and customers to adjust raw material inventories appropriately.

|

|

| Environment | Environmental Protection |

•

Require subsidiaries’ manufacturing sites to reduce process water usage, install wastewater recycling equipment, and improve wastewater treatment efficiency, aiming to maintain a stable water recycling rate in the short term.

|

| Climate Change |

•

Implement energy-saving and carbon reduction measures. Conduct annual greenhouse gas inventories with the goal of gradually reducing CO₂ emissions year by year.

|

|

| Social | Talent Recruitment |

•

Implement talent development policies, supplemented by planned and systematic training programs, to reduce the impact of human resource gaps on the Company.

|

| Corporate Governance | Regulatory Compliance |

•

Establish governance structures and internal control mechanisms to ensure that all personnel and operations comply with applicable laws and regulations.

|

| Information Security |

•

Strengthen protection against external threats and track monitoring, enhancing cybersecurity transparency to reduce operational risks.

•

Develop compliant management mechanisms and periodically review and revise them to meet up-to-date cybersecurity standards.

•

Establish a highly available information service platform to ensure continuous business operations.

|